Please note that the information provided here is for reference purposes only. Ensure you verify any related information directly from the official resource to avoid any misinformation or understandings: https://www.mct.gov.cn/

Currency

The official currency of China is the renminbi (abbreviated RMB or CNY), also called yuan. Yuan come in 1, 10, 20, 50 and 100 yuan notes and 1-yuan coins. Each yuan divides into 10 jiao. The country also uses 5 jiao and 1 jiao coins.

Payment Methods

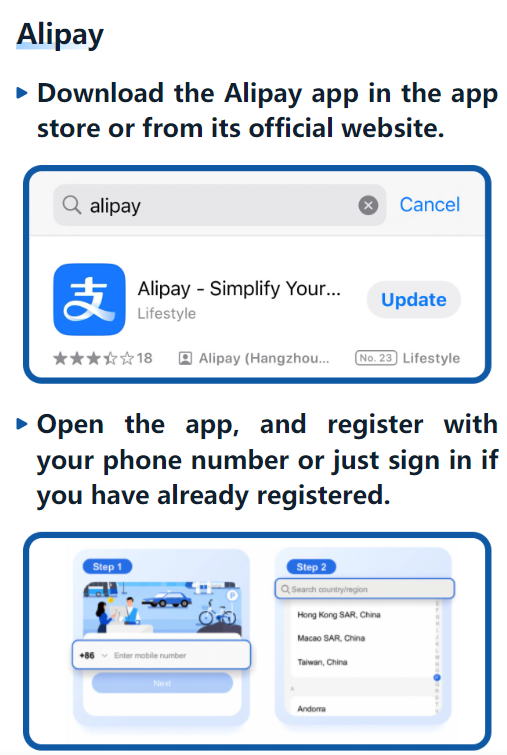

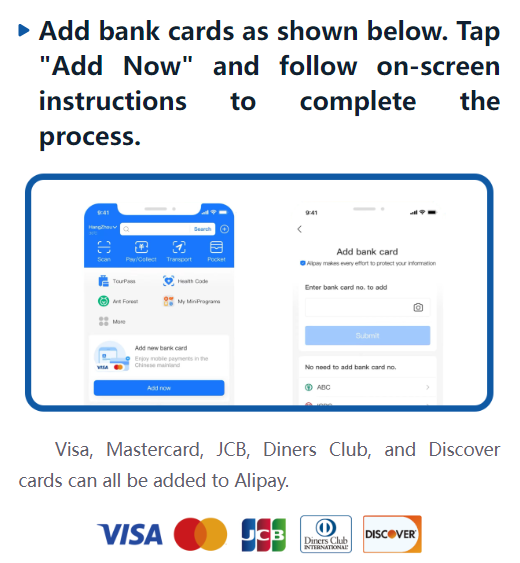

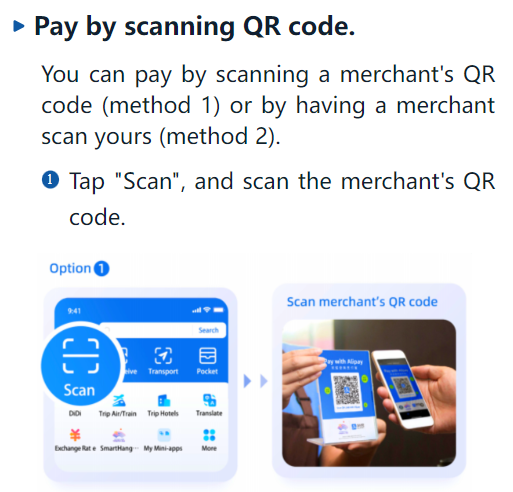

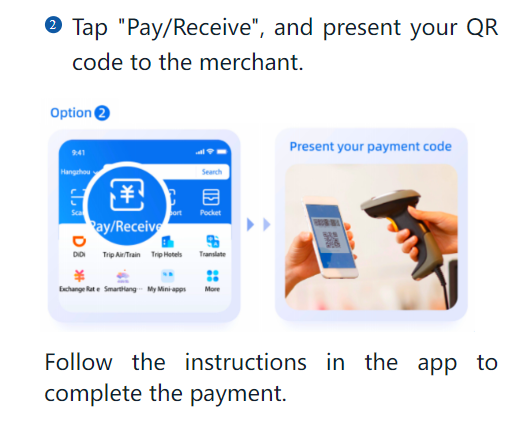

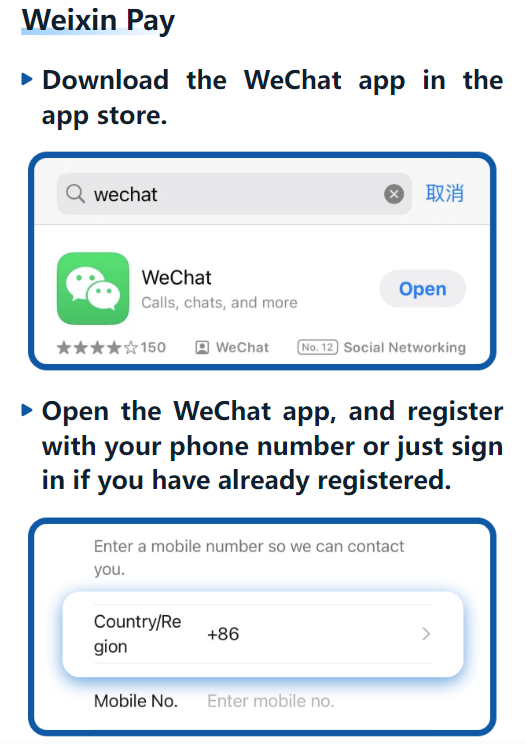

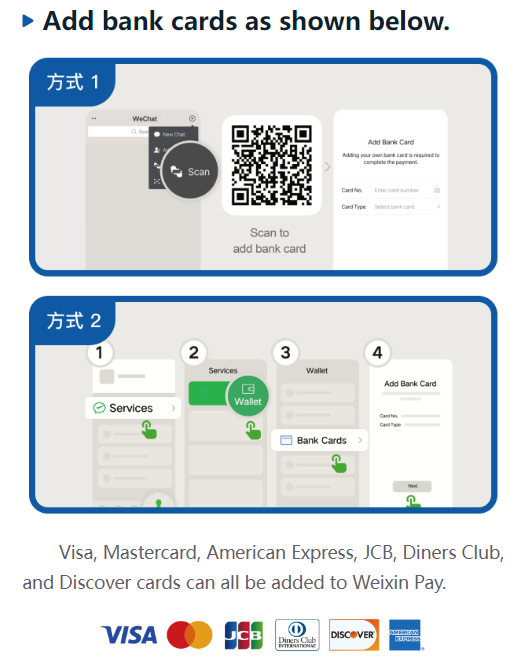

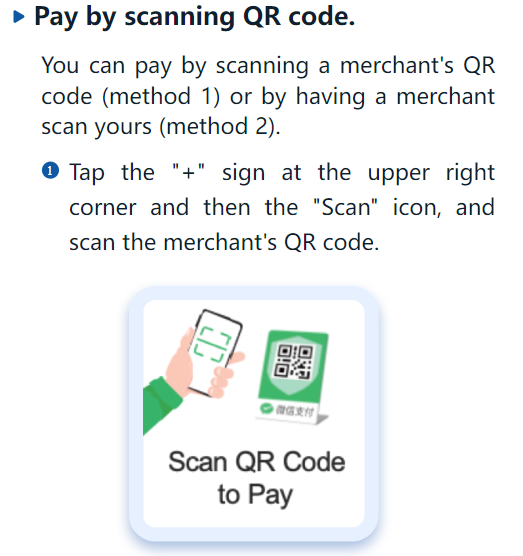

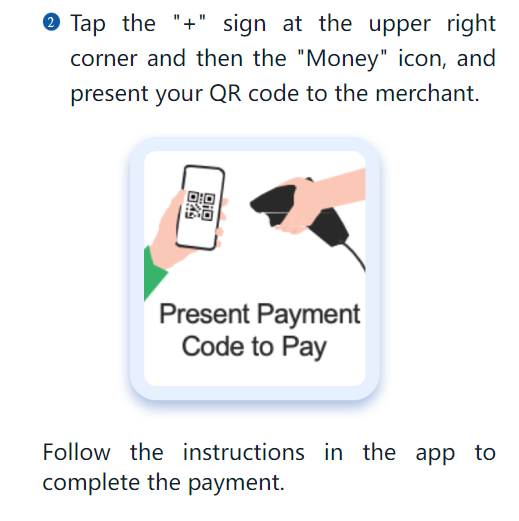

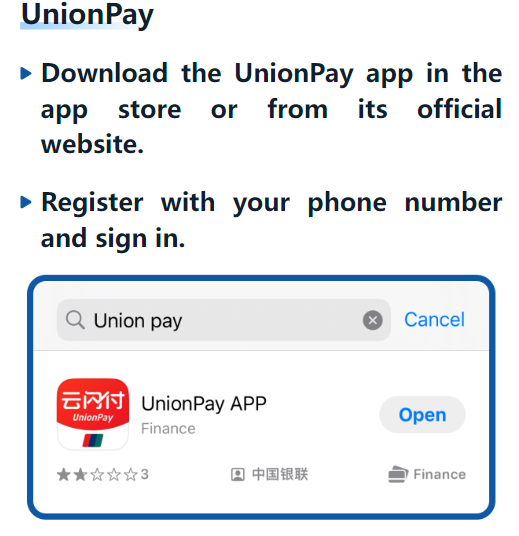

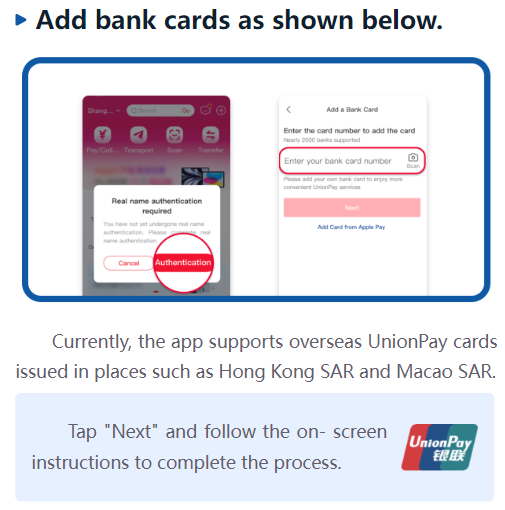

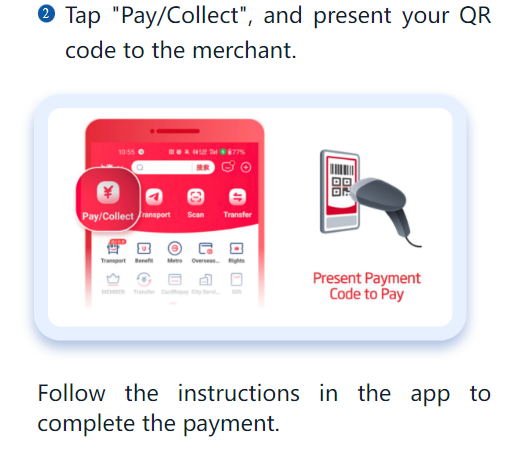

The most convenient payments methods in China are cash and credit card. In terms of credit cards, most business accept Visa, MasterCard, American Express, UnionPay and JCB. Digital payment methods such as Alipay and WeChat Pay are also widely accepted in China. To use digital payments, you can download the overseas version of the Alipay app to your smartphone and then apply for an electronic spending card through the “TourPass” applet in the app. To use the spending card, you will need to verify your identity and then add an overseas bank card to top it up. The card can then be used to make payments across the country wherever a blue Alipay QR code is displayed, allowing you to experience China like a local, paying for anything from fruit and veg to dinners, hotel bills, and travel tickets with just the mobile phone in your hand.

Foreign Exchange

International airports are generally equipped with counters for exchanging major foreign currencies (euro, dollar, sterling). Cash machines also allow you to withdraw money from foreign cards in the local currency.

Exchange rate (as of November 2021)

1 euro = 7.5 RMB

1 US dollar = 6.4 RMB

1 pound = 8.6 RMB

Foreign currency exchange services are available at Bank of China, Industrial and Commercial Bank of China and other major banks. An appointment booked in advance is required.

China’s Departure Tax Refund Policy

- Tax refund policy:

Visitors from overseas or Hong Kong, Macao and Taiwan leaving mainland China via a designated port of departure can receive a refund of the VAT paid on tax-refundable goods the visitor purchased in tax-free shops while in mainland China.

- Eligibility:

Foreigners and visitors from Hong Kong, Macao and Taiwan who have been in mainland China for no more than 183 consecutive days before their date of departure may claim the refund.

- Requirements:

- The visitor must have spent at least 500 RMB in one tax-free shop in a single day.

- Tax-refundable goods must be new and unused.

- The purchase date of the tax-refundable goods must be no more than 90 days ahead of the departure date.

- Refund rate:

Tax will be refunded at a rate of 11% of the total price of the item (including VAT). From this, the tax refund agency processing the refund will deduct a 2% administration fee.

- Tax refund method:

The tax will be refunded in RMB and can be paid either in cash or by bank transfer. If the tax refund exceeds 10,000 yuan, however, it must be paid by bank transfer.

For more information, see the State Taxation Administration website: http://www.chinatax.gov.cn/eng/c101280/c5099665/content.html

Hainan’s offshore duty-free policy (as of July 2020)

Hainan’s offshore duty-free policy offers duty-free shopping to travellers who depart the island to another destination in China (i.e., do not go directly abroad) by airline, train, or ship. Eligible travellers can purchase goods without paying various import duties, though there are limits on the value, quantity, and types of goods. The duty-free goods must be purchased at offshore duty-free shops or approved online websites, and the goods must be collected at the designated area of the airport, train station or wharf.

Eligible passengers:

Foreign and domestic travellers, including Hainan residents, aged over 16 years old, who hold a valid ID (an ID card for domestic travellers, a travel permit for Hong Kong, Macao and Taiwan travellers, and a passport for foreign travellers) and have purchased tickets for an airplane, train or ship to leave Hainan Island but not the country.

How does it work?

The duty-free shopping allowance is 100,000 yuan (approximately 13,500 EUR) per person per year, with no limits on the number of times purchases can be made.

For more information, see the State Taxation Administration website: http://www.chinatax.gov.cn/eng/c101280/c5155205/content.html

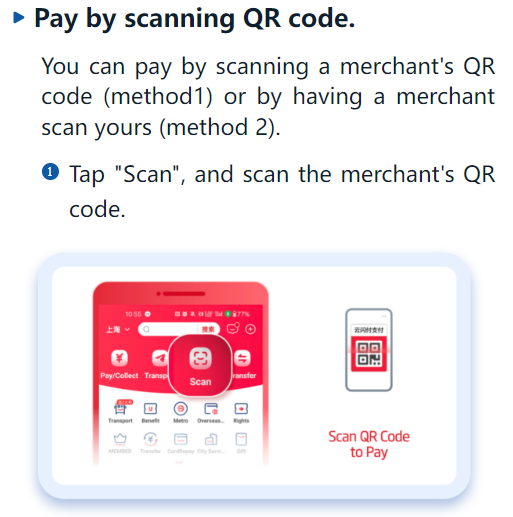

For more information about guide to payment service in China, please refer to the following QR Code: